tv Mad Money CNBC March 25, 2013 11:00pm-12:00am EDT

11:00 pm

>> it's been a great week for flat 12. i bought the gold lemans as part of a package deal for 12,500. add 1,600 in expenses, we sold it for an even 17,000, giving us a profit of 2,900. the factory five roadster i bought for 25 grand. we add 1,000 in shipping costs, i sold it for 33,000. that gave flat 12 a cool 7,000-dollar profit. the fast & furious buick we bought for 10 grand. we put 1,450 in it, we made a profit of 3,050. we bought the lincoln for 700. we spent another 700 on expenses. the hammer dropped on it, and she sold for 3,400. we made 2 grand. so in total, we made close to 15 grand on four cars. not a bad week. the week wasn't over yet. we still had to collect on our bet. dad had to take me to the best sushi restaurant in lubbock. hey, yeah. >> oh, yeah.

11:01 pm

[laughter] >> too bad he doesn't like sushi. this food is gonna go down so nice. >> when it's free, it always... >> jeff and meg: goes down nice! [meg laughing] >> it goes down a lot better that way, does it? yeah. >> i'm gonna have the steak and scallops. >> gonna go with the... california dinner with the clear soup. >> eric, remember. you can order out, dude. you're not paying. [laughter] >> see if they have lobster right quick here. >> lobster! >> let me tell you right now. you're gonna eat it all. >> i will! >> he never orders sushi! >> maybe not tonight, but i will. >> no, it's all. >> all: ohh! >> they have fried ice cream too, eric. >> ah. >> save room. just keep ordering. [laughter] >> bunch of goobers.

11:02 pm

and built alt i'm jim cramer and welcome to my world. >> you need to get in the game! firms are going to go out of business and he's nuts, they're nuts! they know nothing. >> always like to say there's a bull market somewhere. >> "mad money" you can't afford to miss it. hey, i'm cramer. welcome to "mad money." welcome to cramerica. other people want to make friends. i want to try to save you money. my job is not just to entertain but do a little educating and teaching so call me at 1-800-743-cnbc. you figure it would have to

11:03 pm

spill over eventually. the ham-handed way the europeans handled that cyprus situation. dow sinking 64 points, nasdaq down .30%. i had feared that even the best of all the worst plans like this one would be viewed askance by the rest of the world's financial capitals, and that's what happened today. why does it have to go like this? why do we first have to react to europe? i think part of the issue is europe has to plan to bring growth back. it pulls the world down to its own suit as if it were wearing cement galoshes. forced austerity allows jobs to be taken away without environmental enforcement. why build factories in europe when you can make them in

11:04 pm

mexico, pollute the air, cheap energy for the factory and low shipping costs? that's become the american way. i'm calling it continental-cide. the second issue is credit. confiscating deposits will inspire fear when confidence is needed. fear makes people act differently. act conservatively. it takes away the confidence they need for the future. that tightens credit. never forget that the etymology of credit is the latin word credere, which means to believe. how can you believe in a continent or a currency that can have your money locked down or crunched as is the case in cyprus? i can't get credit to build and can't get credit to buy, can't get cash to eat. so that spills over to our industrials. many of our companies need european credit to get people over there to buy our goods. you can see how a worldwide slowdown could be viewed as in the wind. that's why caterpillar and deere have been going down.

11:05 pm

they have business in europe. you need credit to buy capital goods like they sell. dead cat not bouncing. bambi's mom getting shot at. that's caterpillar and deere. at this moment, thumper's had better days. the classical cyclicals gravitate to homes. they are both positive for the u.s. it just doesn't happen in a day. these are different gravitations than those that are being sold. the first after a moment's hiatus is back once again, the flight to safety. soft goods and consumer goods, stocks like pepsico and kellogg and kraft, as well as various high-dividend pharmaceutical companies, many of which were up today. any time you think it's too late to buy these, the money flows back into them. they do well with a worldwide slowdown. i thought valuations were stretched more than the multiple will allow. but consider for a moment general mills. it's finishing a fabulous

11:06 pm

restructuring, it's beating earnings, it's innovating, able to raise price at the same time inflation is coming down. that allows the country to return bountiful amounts of cash to shareholders in dividends, buybacks or both. when the europeans say the template will be the cyprus disaster, that action forces money into the first national bank of general mills. with a terrific balance sheet and sweetened dividend. i would rather own cheerios than eurios. though owning oreos may be another fabulous place to hide from eurios. better tasting, too. you know why? because you can't open a eurio and lick the icing. the second gravitation is to our banks. that is most likely going to happen tomorrow. if you're a european fiduciary

11:07 pm

or an audit committee member from a publicly traded company, you have to listen to what europeans are saying and it may not be prudent. you may not be demonstrating prudence keeping your money in a european bank. shareholders can actually sue you for doing so after the cyprus solution. you want a stable currency? you want to be in a united states bank. with these big banks, all you've got to do is wire your money from the first european bank of total crisis flim-flam to jp morgan or citigroup. while we are at it, when the big banks go up, the little banks follow. for all you ben bernanke bashers, have you ever thought about how they ignited belief in

11:08 pm

our system? you can't believe any corporation would keep money in those european banks unless they have members on the board which a lot of them do. europe is bad news. we've sold almost every company with substantial european exposure for the charitable trust. we had a crisis meeting about that today. unless it's a food or drug company who needs a headache? we are wary of tech because tech does so much business in europe. this country? how can you ignore the american retailers and reits when cyprus brings them down? does that make sense to you? it doesn't make sense to me. how can you ignore master limited partnerships that give you yields and high growth, trust bought one today. how can you say no to the home builders? lennar just reported terrific numbers. affordability rates for homes are the best they have ever been, with credit just now coming back to the mortgage market. so we go through the pain of europe as they inspire nothing but fear and suicidal austerity. we recognize they have no plan

11:09 pm

except making it impossibly expensive to create jobs. workforce rules are a nightmare. energy costs are through the roof with the obsession of renewables. our country is making the most strides against greenhouse gasses. we see hegemony in germany and say wasn't that why the euro was created to avoid old war wounds that lead to new ones? with the shock of cyprus and europeans washing over our market like it does 10:00, 11:00, we return to the american stock market normalcy tomorrow. i have another way to look at it. those who shopped at walmart and costco before cyprus, i bet you're going to shop there now, especially with those free samples. those who bought kleenex and tylenol before the close -- forgive me. i bet they'll buy those goods tomorrow. for those who drink pepsi and coke

11:10 pm

will keep doing so despite the crushing of the russian oligarch-laundered money. i'm liking diet mountain dew. it's a little better tasting now. those who bank at bank of america and jpmorgan will be thrilled they do. europeans will join them after the cyprus debacle. europe never fails to hurt our markets initially. the great ceos never seem to fail to inspire us a few days later. it will remain the pattern as long as our economy keeps growing and it will be the pattern as far as the eye can see. i want to take callers right now. i did a mess with the cheerios boxes here. mark in new hampshire. >> caller: jim, how are you? >> i hurt my back on saturday. >> caller: lake winnapesaukee boo-yah, brother. i've got a question for you.

11:11 pm

i own monster. i did really well. was up by 200%. i didn't sell it like an idiot. now it's down and i wonder if i should dump it now because of the heart attacks and last week's study about the heart conditions, all that good stuff? i don't know if i should dump it, even though i'm up a little bit and take that and maybe buy something else to try to get my position down. >> first of all, you're too hard on yourself. when you say you're an idiot, that's the way i talk. don't ever be like me. you're going to have to take medicine. here's the problem. there have been a couple senators writing these letters about monster and the letters read real bad, okay? you don't want senator -- we have enough problems with stocks. we don't want senators putting the hate on you. hi, hater, i'm a seller. mnst. sell, sell, sell! brent in mississippi, lasalle. >> caller: how you doing, jim?

11:12 pm

>> i'm ole missing here. >> caller: you got it, man. they're rolling, or were. >> they were. they ran into a veritable buzz saw. what's up? >> caller: they did a great job. got a question for you. in light of today's news about the additional bad offers on dell, we want to know how to make the play on dell for the rest of the year? puts, calls, tell us all. >> dell, sell, sell, sell. try to make an extra 85 cents for a $4 downside? i say ka-ching. for every action there's a reaction. maybe newton was talking about the market. we have to react to the mess in europe. it's a pattern that will keep happening as far as the eye can see. remember, we prefer cheerios to eurios. "mad money" will be right back. coming up -- chewing it over. the maker of duncan hines, classic and mrs. butterworth is

11:13 pm

testing the market's appetite for its brands with an upcoming ipo. cramer is offering a bird's eye view to find out if you should take a bite before it starts trading. later -- invest in innovation? it's the latest gadget to drive profit in your portfolio. medical science is leading the way with breakthrough technology. tonight, cramer's kicking off a week-long series highlighting some of the most revolutionary companies that maybe heading higher. plus, pour on the profits? infrastructure in the states has seen better days. could the wave of capital used to bring it up to speed help increase your cash flow? tonight, cramer sits down with the ceo of american water works just ahead. all coming up on "mad money." don't miss a second of "mad money." follow @jimcramer on twitter. have a question? tweet cramer, #madtweets. send jim and e-mail to mad

11:14 pm

11:17 pm

for as we approach the end of the first quarter, we are pointing out so far 2013 has been a red-hot year for ipos. last week alone we had six new deals. to get you 10% pop on the first day of trading. for of this not so great day for the averages, i thought it might be worth reminding you it's possible to make easy money in this market via these bountiful initial public offerings. obviously not all ipos shoot up. last week they came down 5.6% on the first day of trading. keep that in mind. it's now a fabulous environment. last week's other four ipos were up 14% to 20% on the first day. all the tech names work so well. that's why i wanted to introduce you to a new company. it's called pinnacle foods. it's a house of food brands.

11:18 pm

some say like b&g expecting to come public on thursday. pinnacle is a company you never heard of, i bet. but its products can be found in 85% of american households. you would almost certainly recognize their brands. they've got a big frozen food business with bird's eye frozen vegetables, mrs. paul's seafood, lender's bagels, celeste pizza, as well as hungry man frozen meals that i thought looked like a delicious heart attack in a box. and pinnacle also has a grocery business. you know them as duncan hines, cookie and cake mix, mrs. butterworth, log cabin, comstock pie filling. these are some iconici american brands, and as we know from heinz from its all-time high last month, iconic brands are the landmark. blackstone is ringing the

11:19 pm

register on its investment by taking the company public. recent history suggests these deals are now performing extremely well. case in point, since the beginning of 2013, we've seen 30 ipos, 13 backed by a financial sponsor like private equity or venture capital. the average ipo this year spiked 15% on the first day of trading. these 13 financial spots ordeals were up an average of 22% on the first day of trading. these private equity firms look like they want to make money on the first tranche they sell. i'm not recommending you get into pinnacle on the first day. i like the fundamentals of the underlying company. pinnacle has a lot in common with b&g, it given you 128%

11:20 pm

return with reinvested dividends. i wish b&g would explain the last quarter. pinnacle has a habit of acquiring neglected brands. think pinnacle's log cabin, vermont maid, and breathing new life into those brands. that's what the company did when they bought duncan hines. my mom would call it drunken hines for no good reason. she would never use it. pinnacle did the same thing in late 2009 when it bought bird's eye, making it -- chilly. i have a bad back. this is good. we'll leave it on for the time being. bird's eye making itself into the fifth largest frozen food maker in the united states. my mom did serve bird's eye and log cabin so i've got a soft spot for this one. pinnacle has been using its bountiful cash flow to pay down the -- it's cable -- pay down the mountain of debt incurred when blackstone took over.

11:21 pm

it will use the proceeds to pay down a major chunk of high-interest borrowed money. they will have around $2 billion of debt. it's a food company and can handle that. use this food story as a variant on the macarthur dictum. old food brands, they never die. they don't even fade away. if they have a currency, they can buy new brands aplenty. there is plenty for sale. they can also issue a lot of stock and clean up and refinance the balance sheet. pinnacle plans to sell 29 millions shares 18 to $20. they plan to pay a quarterly dividend. they are going to give you a 3.8% yield. where can this stock go? midpoint of the price range, market capitalization about $2.2 billion. it would be trading at less than 0.9 times trailing sales.

11:22 pm

in contrast, b&g did just turn $64 million shares. trading 2.5 times sales. of course there are reasons why b&g should have a higher valuation than pinnacle. it's a much cleaner balance sheet with only about $618 million in debt. pinnacle have 2 billion in debt after the ipo. they will have $1 billion with net operating carryover which allows pinnacle to use its losses to cancel out the taxes they might owe for profits down the road. the corporate income tax bill will be tiny to nonexistent for years to come. there is another reason b&g gets a higher valuation and that's growth. b&g has been growing sales consistently while pinnacle sales have been flat. the valuation disparity with b&g, let's say pinnacle deserves to trade at 1.5 times sales. still a big discount to b&g. it would make this a $30 stock which is 50% higher than the high end of pinnacle's price

11:23 pm

range. i think $30 is therefore a reasonable target, especially since they are making smart moves. they are cutting costs. management is doing a terrific job. they held a conference call acting like they were a public company. the environment seems to be improving. pinnacle can always do another acquisition. the company is paying you to wait to get their house fully in order with that great dividend. let's not forget, last week ken powell was on the show, he told us that food inflation has peaked and competition is less fierce? that could help these guys. pinnacle foods reminds me of long-time "mad money" winner b&g. they've got some truly iconic ones under the roof. i think you should try to get in on this ipo. that's why i did this story money. call your broker tomorrow. i like it even if they raise the price. even if they take it up to $22 a share. at that point, let's pause, that may be too high.

11:24 pm

after the break, i will try to make you more money. coming up -- invest in innovation. it's not the latest gadget that could drive profit in your portfolio. medical science is leading the way with breakthrough technology. tonight, cramer's kicking off a week-long series highlighting some of the most revolutionary companies that may be heading higher. [ male announcer ] i've seen incredible things. otherworldly things. but there are some things i've never seen before. this ge jet engine can understand

11:25 pm

11:26 pm

♪ i don't want any trouble. i don't want any trouble either. ♪ [ engine turns over ] you know you forgot to take your mask off, right? [ siren wailing in distance ] ♪ [ male announcer ] introducing the all-new beetle convertible. now every day is a top-down day. that's the power of german engineering.

11:27 pm

when the market was really getting hammered earlier today, and of course last week courtesy of the european woes, i came back to the question i always ask whenever the averages get whacked by some supposedly terrifying exogenous event. nobody likes the ham-fisted way the europeans are dealing with cyprus or the way they deal with anything for that matter, but what the heck does that have to do with the price to earnings multiple of bristol-meyers? nothing. that's what. yet this has been my mantra every time something bad happens in the world. going back to my old hedge fund days. as bristol-meyers is your classic defensive big pharma stock, company is going to keep growing no matter how badly the europeans screw up things because people always need their medicine. frankly, i think it's accelerating its growth. it's time to update this dictum in order to keep up with the times, old dog, new tricks.

11:28 pm

the big pharma stocks have been on a real roll lately. i liked bristol myers. we own it for our charitable trust. when i started screaming what that had to do with the price-to-ratios, it was the heyday when the major companies were growth juggernauts and their stocks were valued accordingly. let's take 1998, your typical big pharma stock traded between 30 to 40 times earnings. these days they trade in the low teens or even lower. many trade like fixed income vehicles. most of the huge blockbuster drugs from the '90s have gone off patent. they lost that spark of innovation that made their stocks such powerhouses back in the days of yore. so all this week, i want to go where the innovation is. i want to find the companies that could be the next gigantic pharma names.

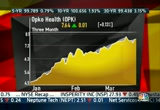

11:29 pm

some of them already are. these days that means looking at the larger biotech outfits with deep pipelines that are growing up fast. in short, the next time you hear some hand wringing about cyprus, i want you to think, what's that have to do with the price-to-earnings ratio of celgene? because celgene, the big cap cramer fave biotech firm, is today what the big pharma stocks were during their heyday in the 1990s. celgene has rallied 42% since the beginning of the year. hey, smoke show. even with the stock at $112 and change, the darn thing is only selling for 16 times next year's earnings estimates. that's cheaper than the generous mills, for heaven's sake. i think it could have a lot more room to run. celgene has a number of drugs on the market for various types of cancer and blood disorders, excellent pipeline. right now celgene is a three-legged stool. the first and strongest leg is

11:30 pm

the company's multiple myeloma franchise. celgene's drug here is a mega blockbuster that is expected to do an incredible $14.1 billion sales in 2014. it now has the potential to do peak sales of $6 billion treating multiple myeloma. you don't see the same kind of off label use in europe which is why celgene has been trying to get the drug approved over there. it could be a billion dollar opportunity for the company. back in june the company withdrew its filing in the eu and the stock got slammed from $67 to $59 as everybody freaked out about celgene's future. i told you to stick with it. the ceo came on the show and he is a terrific ceo.

11:31 pm

the stock is now up 88% since then. i thought we were alone when we said it was okay. if you had to pull back on this stock, don't panic. buy the darn thing hand over fist. celgene should file for european approval for revlimid. people said they will never refile. he said they will refile. that is putting a billion dollar opportunity on the table. they are studying revlimid for non hopkins lymphoma and a number of forms of leukemia. any one could be a huge opportunity for celgene. they have a whole pipeline on a single drug. they have another drug that just received fda approval six weeks ago for patients who aren't responsive to revlamid. it could have a host of other indications down the road including systemic sclerosis, autoimmune disease and a bone marrow disorder and also sickle cell anemia.

11:32 pm

that's the first leg of the stool. the company has two more. the second abraxane. that is another multiple indications play. last year got fda approval for non-small cell lung cancer. they have preclinical trial results showing it could help with pancreatic cancer and metastic melanoma. sales are going to $1.5 billion by 2015. pancreatic cancer indication could be worth only $2 billion in sales if they get it right. the third is apremilast, a candidate that has shown results for psoriasis and arthritis. the drug could generate $3 billion in peak sales. not only does it have a terrific slate of products in the pipeline but has the best

11:33 pm

management -- no, no, that's not fair, but among the best management. if you're frightened at that $112 share price, they have great long-term visibility. they are talking about a stock trading 8.6 times the at-years. i wish we caught this earlier, but we did. i'm reiterating my long-standing buy recommendation and trying to put it in the context of the rest of the group. in the 1990s big pharma companies were growth juggernauts. these days their growth has slowed. even up here celgene is a buy. i would like it more on a pullback. maddy in new york. >> caller: how are you? what a thrill to speak to you. i've been a huge fan of your show. thanks for all you do for the small investors out here. >> thank you. >> caller: i'm calling about sanofi.

11:34 pm

i bought this in the $30s with a nice gain. you always tell us not to be greedy. it hit a 52-week high a few days back. what i'm curious to know if you think this stock has legs? >> i do. the ceo has been on the show a number of times. the yield is good, the balance sheet is good. please do not sell this stock. it's a really good stock. mark in florida, please. >> caller: tampa, florida, boo-yah! >> i was going to give you a florida gulf coast boo-yah. what's going on? >> caller: i want to know about opk. is that a buy or not? >> it has spiked gigantically. i'm going to be a little cautious and suggest you pull back. we had phil frost on. there were so many doubters @jimcramer on twitter, i had to blast them like i've been blasting people. i've been going at them.

11:35 pm

guess what. he who laughs last owns opk. joe in california, please, joe. >> caller: good afternoon, jim, boo-yah. thank you for all your help in developing my investor confidence. my question today is i own abbott. they spun off into avi. one has gone down in price on abi yields 4.1%. i'm conflicted over what to do with the spin-off? sell one, consolidate into the other? similar question for conoco and psx at a later date. >> my mistake has been for charitable trust, i think both are great. we kept abt. same thing goes with the oils. you know what? both pieces tend to do well. these are real home runs. big pharma companies have passed the baton to the biotech. celgene has the breakthrough drugs in the pipeline.

11:36 pm

11:39 pm

>> it is time, it is time for the lightning round. cramer takes rapid-fire calls and i tell you whether to buy, buy, buy or sell, sell, sell. we play to this sound and then the lightning round is over. are you ready, skee-daddy? time for the lightning round. i'd like to start with lee in california. >> caller: hey, jim. sunny boo-yah from california. >> i wish i were there what's going on? >> caller: in view of the turnaround in the housing industry, i feel that the more than new houses, the more new lawns, the more new lawns, the more new lawn mowers, what is your opinion of the briggs and stratton corporation? >> i think that is a terrific buy. that's been one of our highly recommended stocks since superstorm sandy. ian in florida.

11:40 pm

>> caller: hallandale beach booyah to ya. i held the position of avy for the last five years. i bought in the high $40s. i'm just wondering is there more. >> there is more. the company is restructured. it's done a good job. buy it, keep holding on to it and buy more even. gary in new mexico. >> caller: mr. cramer, how are you doing this afternoon? >> i'm doing fine. how about you? >> caller: not too bad. my question is about home loan services solutions, hlss. beat up last week. pulled back a little today. >> servicing rights business is a good business. i also like a company called acquine. there are a lot of companies in the servicing rights business that are good.

11:41 pm

i like them very much. i wrote a series of articles this weekend in realmoney.com. i'm bullish. let's go to jim in florida. >> caller: how about a big jim red, white and blue cramer boo-yah. >> i'm liking that boo-yah, thank you very much. >> caller: i'm looking for something in the offshore lng type stuff, hercules offshore. >> it's up very big versus the others. i'm not going to bless it here. i think the others are behind it. i'd rather pick up another one in that segment. rick in michigan. >> caller: boo-yah from grand rapids, michigan, jim. >> nice. >> caller: my stock is mx, i'm up 110%. >> you're being a little greedy. you know what you do, cut it in half and let the rest run. that was taught to me by the master many, many years ago.

11:42 pm

we know who she is and we are sticking with her. let's go to robert in tennessee. >> caller: boo-yah, jim. how you doing? >> not bad, how about you? >> caller: it's my birthday so i'm good. >> happy birthday. >> caller: thank you, sir. quick question about prospect capital. psec. >> these are like these mezzanine loans. if i want 11% yield, i'm going to go to annaly. i spent a lot of time talking about it this weekend. nly for 11%. dan in michigan. >> caller: thanks for taking my call. your articles on real money are very helpful. >> thank you. i was a lean, mean writing machine this weekend. what's up? >> caller: carnival cruise lines, with all the troubles they've been having, their stock is down about 10%. is it a buy at these levels? >> we recommended the stock. we did not think they would continue to have this execution problem. i'm confounded. i have to say right now -- don't

11:43 pm

buy -- you're in the penalty box if you keep having those problems and they keep having problems. and that is the conclusion of the lightning round! coming up -- pour on the profits? infrastructure in the states has seen better days, but could the wave of capital used to bring it up to speed help increase your cash flow? tonight, cramer sits down with the ceo of american water works just ahead. [ indistinct shouting ]

11:44 pm

♪ [ indistinct shouting ] [ male announcer ] time and sales data. split-second stats. [ indistinct shouting ] ♪ it's so close to the options floor... [ indistinct shouting, bell dinging ] ...you'll bust your brain box. ♪ all on thinkorswim from td ameritrade. ♪ ♪ [ male announcer ] every car we build must make adrenaline pump and pulses quicken. ♪ to help you not just stay alive... but feel alive. the c-class is no exception. it's a mercedes-benz, through and through. see your authorized mercedes-benz dealer for exceptional offers through mercedes-benz financial services.

11:46 pm

they're coming. yeah. british. later. sorry. ok...four words... scarecrow in the wind... a baboon... monkey? hot stew saturday!? ronny: hey jimmy, how happy are folks who save hundreds of dollars switching to geico? jimmy: happier than paul revere with a cell phone. ronny: why not? anncr: get happy. get geico. fifteen minutes could save you fifteen percent or more.

11:47 pm

you know what made a brand-new intraday high on this one? american water works. the largest publicly traded water and waste water utility in the united states. it's up 10%. american water works sports a 2.5% yield which seems meager compared to the electric utilities, but this company has something that most electric utilities don't have, honest to goodness organic growth opportunities. by the way, it can acquire. our water infrastructure in this company is aging and terrible. our municipalities are crash-strapped. so many of them and many military bases are privatizing water utilities which creates numerous opportunities for american water works to expand. it's got a small but rapidly growing business providing water for hydraulic fracturing in the marcellus shale. got a homeowner services business. they can protect against the cost of broken or leaking pipes. they have a bio solid waste business, too. not a cheap stock.

11:48 pm

17 times next year's earnings, 8% growth rate, extremely consistent. let's check in with jeffrey sterba, the president and ceo of american water works to find out more about his company and where it is headed. welcome to "mad money." >> great to be here, jim. >> all right. we've got $400 billion in infrastructure that's rotting in this country. what role can american water play in getting this changed? >> a lot of things. the most important one is investing in the infrastructure where we need to double or triple the amount that's being put in this out of sight, out of mind water and waste water infrastructure. when you think about it, jim -- go on. >> wouldn't that be the government that should do it? you guys don't have to spend that money, do you? >> oh, no. in fact, that's what we do. we are fundamentally an infrastructure business. we invest about $1 billion a

11:49 pm

year today upgrading infrastructure to provide waste water services to our regulated customers. we have competitive businesses in which we don't invest, but in our regulated business, that's really what we do. only about 15% of the water infrastructure is privately owned. in most instances, 85% it's municipal or other public entities and it's getting harder for them to keep up with the investment requirements. that's where we see our market potential to grow. >> as an old municipal bonds salesman, i wouldn't give a lot of these municipalities the time of day to raise money to take care of the infrastructure. i would tell them you sell it to american water, that way you get out from under and your water gets improved. maybe people move to your town. is that happening? >> it is. it's not happening probably at the rate i think it will. we did 15 acquisitions last year. most of them are small. a couple were larger in new

11:50 pm

york, but we now serve from new york to california, really hawaii, and canada down to tennessee. we think we can help a lot of the municipalities that are running into challenges because the federal government certainly isn't there to do it. and water is also such a great deal. you pay a penny a gallon and get all you want. >> after i read through all the materials coming out here, i didn't feel like drinking a lot of water from a lot of different places. >> the one thing we think about in our business at american water is more than anything else, we are in the health business. so we have a team of scientists that are committed, and enormous laboratory facilities to help ensure that everything from the head waters where we pull water to the water that's coming out of the tap that people drink is of the best quality. i'm very comfortable with the condition of our water. let me give you one quick statistic, jim.

11:51 pm

there's over 11,000 notices of violation in the country of violations of clean drinking water regulations. we are about 5% of the market. we should have 600 or so. last year we had four. >> wow. that's a great stat. >> all those were really reporting elements. when i think about the concerns people ought to have, frankly, there's a lot of systems that can't keep up with making sure the water is clean and it's delivered where it needs to be on time. >> speaking of not being able to keep up and deliver the water on time, we have been big observers of what's going on in the marcellus and utica. we had dick heckman on. i'm sure you're familiar with his work over time. this seems like a marriage made in heaven, american water and all these different big shales. is the marcellus -- >> absolutely. no, no, no. in fact, most of the wet gas

11:52 pm

which is getting produced because it's liquids where the oil companies are making their money is, in fact, right in the territory where we have a lot of our systems through southwestern and northwestern pennsylvania and down into west virginia and across the border in ohio. we provided over 350 million gallons of water to frackers. we've entered into a number of pipeline extensions to serve them. we've got contracts with 30 different companies, 16 different points of delivery all through that area. drilling's backed off a bit. it's starting to come back a little bit, but it's been down for a year. we see it starting to ink back where the wet gas is. >> you've got a good story. i wish you had been on the show earlier. i would have liked to catch this lower. if it's going higher, doesn't matter where it's been, just matters where it's getting to.

11:53 pm

>> 10% growth, 2.5% yield is deserving of a higher price. >> when you have a spill, the epa isn't there immediately, it's water and not oil. thank you so much for coming on the show. >> that's jeffrey sterba, president and ceo of american water works. you asked can i have a play on water? this is our play on water, awk. "mad money" is back after the break. ♪ alright, let's go.

11:54 pm

♪ shimmy, shimmy chocolate. ♪ shimmy, shimmy chocolate. ♪ we, we chocolate cross over. ♪ yeah, we chocolate cross over. ♪ [ male announcer ] introducing fiber one 80 calorie chocolate cereal. ♪ chocolate. departure. hertz gold plus rewards also offers ereturn-- our fastest way to return your car. just note your mileage and zap ! you're outta there ! we'll e-mail your receipt in a flash, too. it's just another way you'll be traveling at the speed of hertz.

11:56 pm

andy grove who helped build intel famously wrote in "only the paranoid survive" that the quarter is a perfectly good unit with which to judge a company's performance. he believes that a company's management can change a lot that needs to be changed and adjust quickly to the new circumstances within that three-month period, his vision was correct as we see from many outstanding companies by the day. this morning dollar general reported a terrific quarter. while the stuck had run into the numbers so it didn't close as high as it was intraday, it's important to reflect back to the previous quarter and how gross margins had hurt this very aggressive grower. the company was cautious about its outlook because of a potential price war. the stock got hammered mercilessly. the company adjusted and managed to right the ship within a single andy grove quarter.

11:57 pm

we had no traces of gross margin. dollar general is no longer on the must-sell list but on the must-buy list. best buy had new management and began calling back the bad stores making improvements that changed the outlook for the company's future. the result? a double in no time as investors realized that this company can return to a growth stage aided by the general recovery in housing. we saw the same thing in starbucks where howard schultz ceo promised to turn in europe despite the continent's no-growth philosophy. i'm beginning to believe it is a philosophy, by the way. we are getting that quick turn in yum after the disastrous chinese food scandal. they are clearly following the andy grove dictum of righting the ship in three months' time. who else could perhaps steer a company back onto a solid path after losing its way? i pondered all weekend whether christine day, the excellent ceo

11:58 pm

of lululemon athletica. she might get it right. i know i've been harsh. we have to recognize they took the extraordinary step declaring a recall where no recall would have, others might not have done the recall. i bet lululemon doesn't skip a beat. it wouldn't surprise me if it came back. day is from the schultz school, having worked in starbucks early in her career. this is one of the worse ones, oracle. the story is not good. i know. we own it for our charitable trust. we play the bad with the good here. it is really hurt even though it is a very small position. every time the company had a disappointment like this, it has managed to solve the problems and trend higher over time? every single instance. i know oracle is an expensive company to work with, hence the cloud's ability to play havoc with the business model.

11:59 pm

176 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11